Interest rates around the world are rising at an alarming pace, as central banks admit that inflation is becoming more ingrained, rather than just a series of transient shocks. For many, this feels like the dawn of new regime in monetary policy and financial markets.

Layoffs at major corporations have received a lot of media attention lately. Have you ever wondered why? The reason being most business leaders have begun taking steps to protect their companies from a recession.

A global recession is predicted by other agencies as well to begin in 2023. New borrowing costs put in place to fight inflation cause several economies to shrink. According to the British consultancy’s annual World Economic League Table, the global economy topped $100 trillion for the first time in 2022 but will halt in 2023 as governments continue to struggle against growing costs.

The researcher’s findings are more negative than the most recent IMF forecast. According to Bloomberg, this organisation warned in October that more than a third of the world’s economies will collapse and that there is a 25% possibility that in 2023, global GDP will expand by less than 2%, which it characterizes as a worldwide recession.

The global gross domestic product will have doubled by 2037 as developing economies catch up to the wealthier ones. According to Bloomberg, the East Asia and Pacific region will produce more than a third of the world’s output by 2037, while Europe’s share will drop to less than a fifth as a result of changing power dynamics.

The data from the IMF’s World Economic Outlook and an internal model serve as the foundation for the Centre for Economics and Business Research’s estimates of growth, inflation, and currency rates.

This recession has had a significant impact on the job market and the financial stability of many individuals, especially Gen Z. It is a periodic cyclical phenomenon, and history demonstrates that recessions have frequently affected the world economy.

Recessions hit different age groups differently and Gen Z (those born between 1997 and 2012) face a significant part of it too given their unique situation in the market. Needless to say, the Gen-Z is entering the workforce during a time of incredible upheaval.

Global Recession 2008

Before 2008, the Great Recession had already started. The first warning indicators appeared in 2006 when home values started to decline. By August 2007, the Federal Reserve had injected $24 billion in additional liquidity into the banking system in response to the subprime mortgage crisis. By October 2008, Congress had authorized the Troubled Asset Relief Program, a $700 billion bank bailout. Obama proposed the $787 billion economic stimulus programme in February 2009, helping to prevent a global depression.

Global Recession 2023 Impact on India

The report predicts that India’s economy will reach $10 trillion by 2035 and rank third globally by 2032.

Since the US is one of the great superpowers, a mild or deeper recession will eventually have worldwide repercussions.

The crisis ultimately grew and spread into a global economic shock, manifesting itself in a number of European bank failures, drops in several stock indices, and significant falls in the value of the Indian market.

Given that Indian businesses had significant outsourcing agreements with US clients, a slowdown in the US economy was undoubtedly terrible news for India.

Over the years, India’s exports to the US have grown. However, India was impacted and managed to survive the severe financial crisis of September 2008.

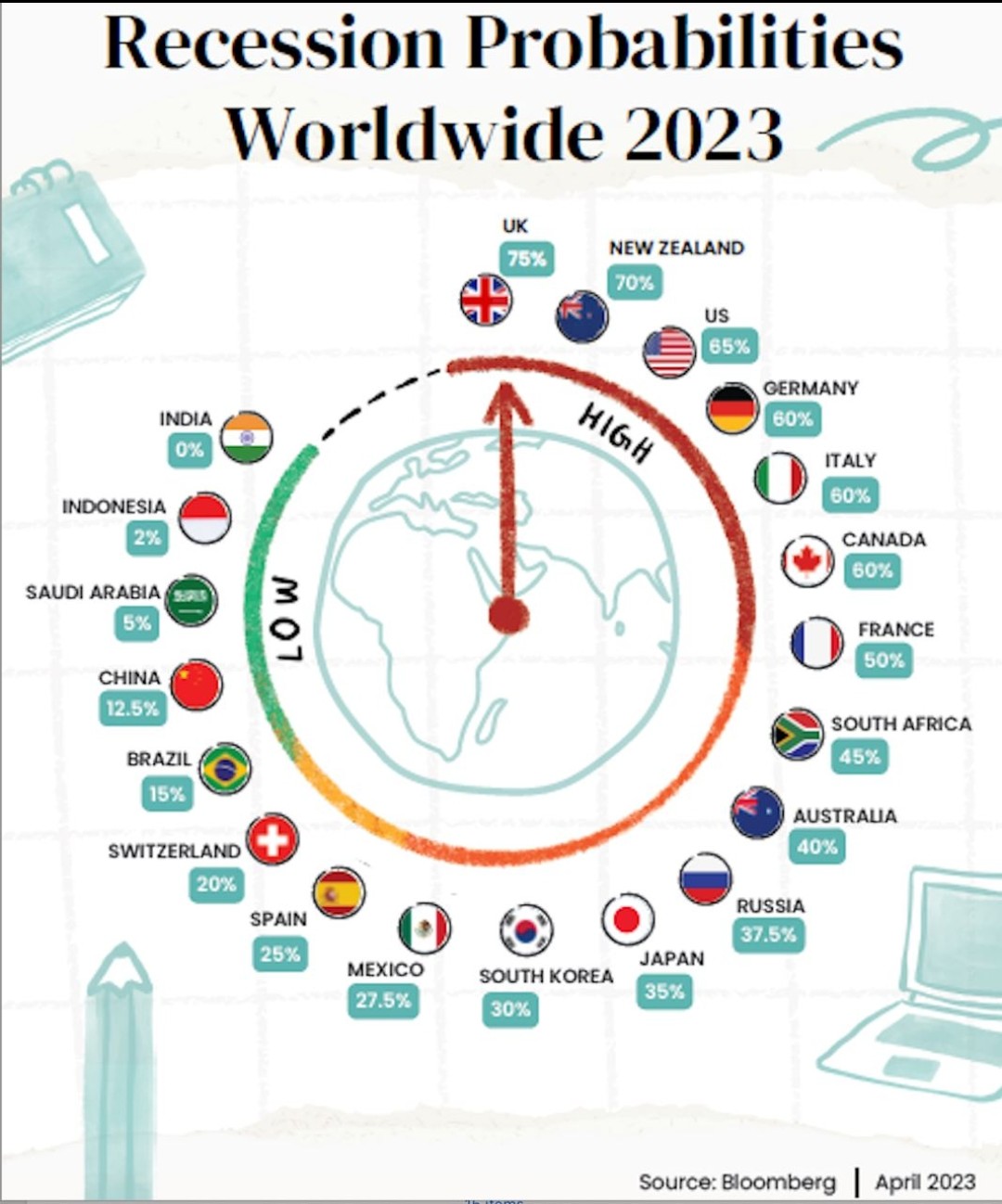

Following is a report about the Recession probability all over the Globe and India stands at 0% as compared to UK and USA , which stand at 75% and 65% respectively

surjitt sahani